Ten Things to Consider When Weighing the Cost of Small Business Benefits

Around tax time, you might start considering the state of your finances. A small business may consider cutting or adding benefits. However, before you make any decisions, here’s ten things to consider about the benefits of benefits.

1. Benefits keep your best employees working for you.

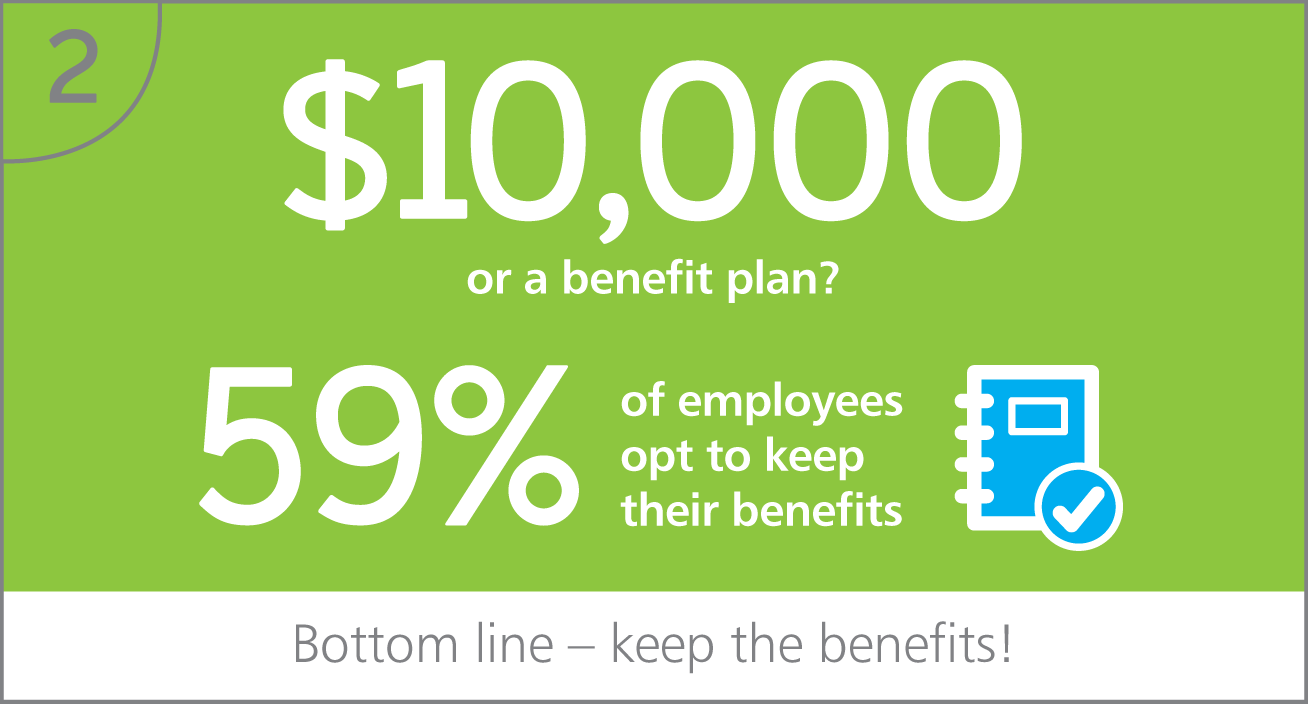

2. Benefits mean more to your employees than money

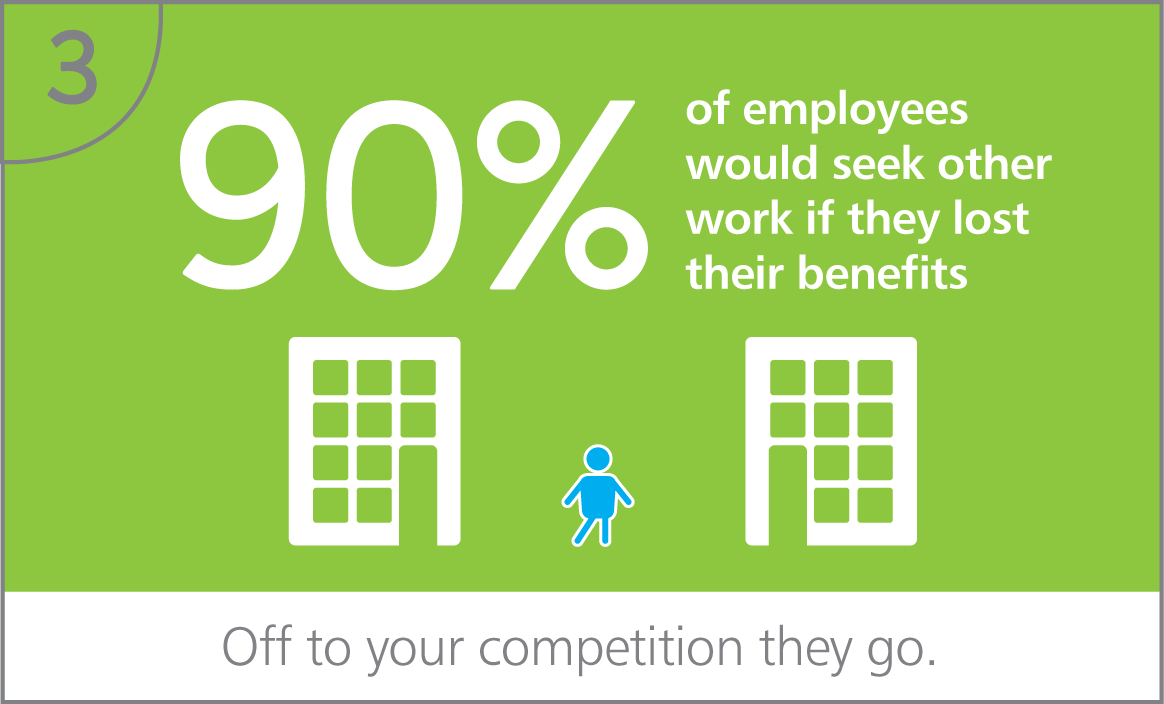

3. Seriously. Benefits really mean a lot to your employees.

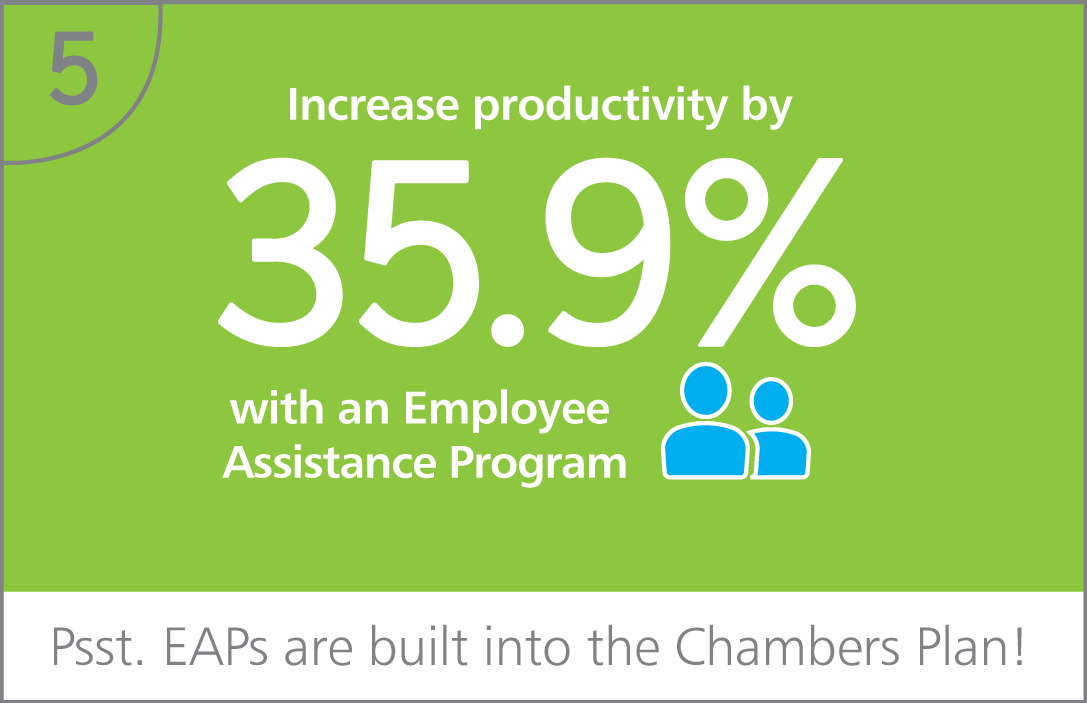

4. You pay for more than just health care and dental. Benefits result in other positive changes around the workplace.

5. Doing nice things for your employees makes you an easier person to work for.

6. Doing nice things for your employees makes you an easier person to like too.

7. Health Care = Happy Healthy Employees. Healthy Happy Employees call in sick less.

8. Health plans are great for morale.

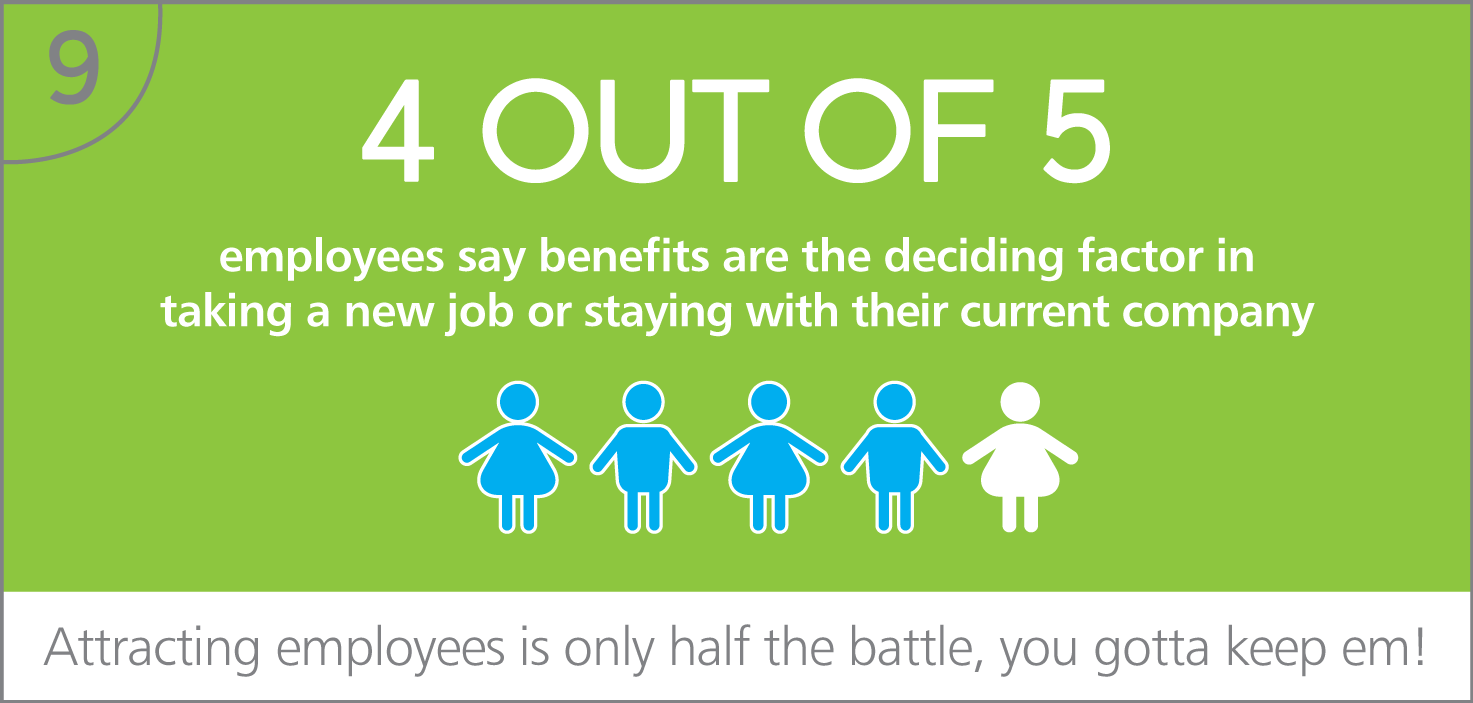

9. You will attract better employees to your business if you have better benefits than your competitors.

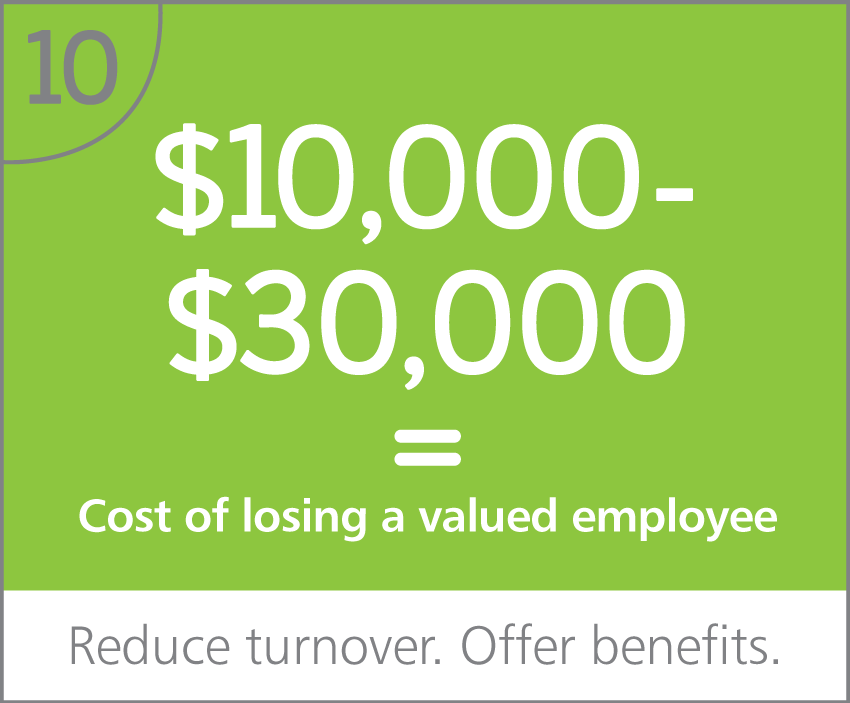

10. Benefits might cost less than a high turnover rate.

You’re never “too small” for benefits!

If you have a small team, it doesn’t mean you can’t benefit from offering benefits. There are plenty of ways to make benefits an affordable and cost-efficient way to improve morale, reduce turnover and attract high quality employees to grow your business.

Plans like the Chambers of Commerce Group Insurance Plan offer affordable guaranteed health care coverage to businesses of all sizes – even with as few as just one person.

If you are considering these options, we’re happy to help. Contact us for some free advice on picking the health care plan that works for your business size and industry.

BenefitsChambers PlanEmployee AssistanceEmployee BenefitsEmployee PerksGuelphGuelph Chamber of CommerceHealh InsuranceSmall Business